Financial scam ads in mobile apps pose an escalating threat to developers and publishers, directly damaging app reputations, eroding user trust, and causing significant revenue loss through churn and negative reviews. Financial scams are a form of clickbait, one of ten identified by GeoEdge, and are a form of malvertising. The premise of these ad scams is tricking users into investing larger sums of money based on fabricated success stories and fake celebrity endorsements. Monetization managers face a growing challenge: scam ads are harder to catch, yet easier than ever for bad actors to serve.

Financial scam creatives often:

- Mimic legitimate investment firms

- Use deepfake endorsements from celebrities

- Change creatives incrementally to avoid detection

But there is no financial gain for consumers–they simply become victims of a scheme that takes their money with no investment return. Google Play and Apple iOS are enforcing increasingly stringent compliance guidelines, meaning publishers who fail to identify and manage mobile financial scam ads sufficiently face consequences such as being delisted from Google Play and the App Store. This can become extra challenging when these investment scams are altered slightly by bad actors in order to serve repeatedly without being flagged.

This blog post explores critical App Store policies, proactive detection, automated blocking solutions, and best practices to secure monetization. Drawing upon AppHarbr’s insider expertise and original research insights, we’ll outline actionable strategies to keep your mobile ecosystem secure from fraudulent financial ads.

Mastering Strategies to Combat Financial Scam Ads

Navigating the evolving landscape of mobile investment scams has become mission-critical for app publishers as the threat persists. Scammers exploit low-cost programmatic channels to run financial ads that defraud users, reaping high returns with minimal investment. Both Google Play and Apple iOS have tightened their oversight, introducing rigorous guidelines explicitly targeting misleading financial advertisements. In response to this, studios and developers must implement an automated control to address fake financial ads before they can be served or flagged by Google and Apple. While manual oversight may seem to solve the issue, it’s impossible for developers to individually block every creative pushed through by scammers, as they change their campaigns ever so slightly to bypass your detection and serve the ad an endless number of times. Google’s financial ad policies require developers to ensure accurate, transparent financial content within apps, subjecting violators to harsh penalties, including steep fines, app delisting, or account suspensions. Similarly, Apple’s App Store maintains strict guidelines to prevent fraudulent financial advertising practices, emphasizing clear disclosure and truthful representations about financial products.

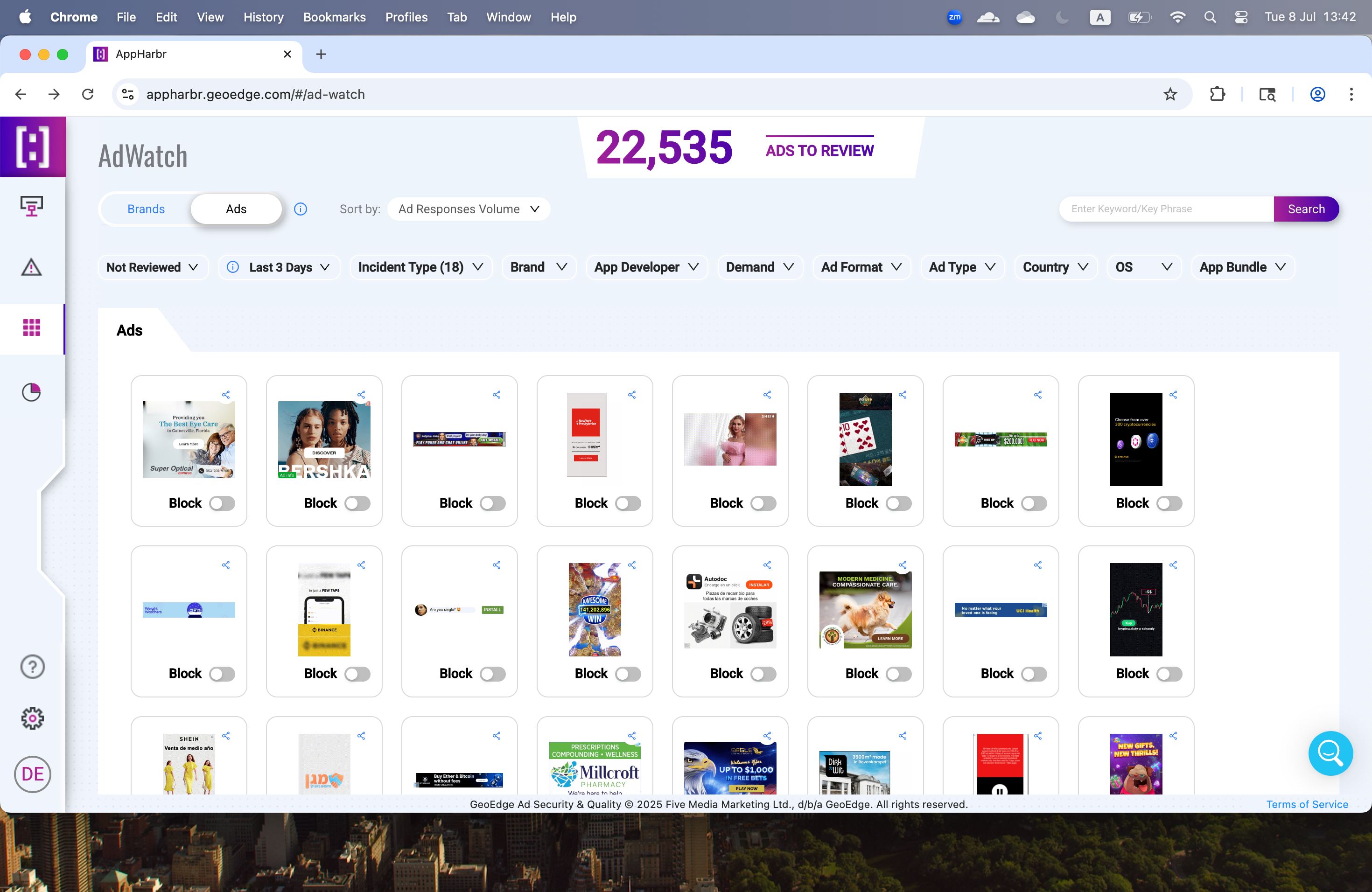

Networks serve these ads because their ad quality controls are not advanced enough to detect and remove clickbait scams. But your team can’t afford to QA thousands of creatives or chase down every suspicious campaign. Manual processes may temporarily remove one instance of a scam ad, but scammers tweak and resubmit new versions faster than you can react.

Solution: An automated, SDK-level ad-quality tool that flags, blocks, and reports scam ads in real time before they serve. AppHarbr integrates directly into your monetization stack, letting you:

- Detect scams at the creative and landing page level

- Instantly block suspicious ads without affecting fill

- Automatically notify networks of policy-violating ads

- Eliminate the need for manual screenshots and incident tracking

Failure to stop the ad before the scam begins not only risks significant revenue impact but also rapidly undermines trust, potentially inciting irreparable brand damage. Automated blocking and reporting tools such as AppHarbr are the only solution that can ensure getting ahead of money scams served in your app. Establishing robust internal protocols and ensuring safe advertising content keeps developers compliant, financially secure, and trusted by millions of users.

Risks of Financial Scam Ads: Consequences for Developers and Publishers

Financial scam ads on mobile devices represent more than just a nuisance—these fake ads pose existential threats to publishers’ reputations and monetization efforts. Once a person encounters misleading or fraudulent sites, trust diminishes, resulting in devastating churn rates and steep drops in lifetime value (LTV). In Q1 of 2025, over one-third of malicious activity was served via clickbait scam, with one in ten instances of malvertising being financial scams. Negative reviews triggered by scam ad experiences compound these risks, with 65% of users warning others of apps where this occurred. This severely hinders new-user acquisition efforts and weakens overall monetization performance.

Beyond immediate financial losses to your business, regulatory authorities increasingly scrutinize fraudulent financial ads in apps, imposing punitive fines, penalties, and legal liabilities that directly hit the publisher’s bottom line. Furthermore, ad fraud issues often snowball quickly from where the scam begins; the door opens to negative visibility not only from users but also from app store platforms and regulators. Publishers who fail to proactively address fraud risk long-term business devaluation, and recovery becomes expensive and challenging. Tolerance of financial scam ads places every aspect of the app business model—from user acquisition and retention to revenue and regulatory compliance—under both immediate and long-term threat.

Proactively Detecting and Blocking Financial Scam Ads with Automation

Manual flagging alone is not sufficient to tackle sophisticated investment scam ads infiltrating mobile app inventory. Today’s mobile advertising environment demands proactive, automated detection tools designed to recognize and eliminate fraudulent financial advertisements before they reach users. By leveraging advanced solutions based on artificial intelligence, publishers can now monitor ad content at scale in real-time, identifying fraudulent patterns, deceptive landing pages, and bad actors that signal financial or investment scams. Integrated mobile ad-quality technologies–delivered through a lightweight, robust SDK–empower developers to automatically detect, flag, and block malicious ad creatives instantaneously, preventing even brief exposure to financial scams.

Employing an automated proactive solution like AppHarbr ensures minimal operational overhead and maximizes your ability to block and report unwanted ads before they reach your users. By implementing proactive detection tools, publishers protect consumers and mitigate compliance risks, maintain platform reputation, and safeguard vital monetization streams. Implementing these resources is essential to ensuring scammers can’t reach users through your app.

| Workflow Task | Without Automation | With AppHarbr |

|---|---|---|

| Ad QA Review | Manual spot checks, easily bypassed | Continuous, real-time protection |

| Incident Reporting | Support logs, screenshots, delays | Auto-generated alerts to networks |

| Network Escalation | Back-and-forth emails, unclear trail | Tagged violations, instant flagging |

| Compliance Review | Manual monitoring of policy updates | Built-in policy engine with updates |

Developer and Publisher Best Practices for Preventing Financial Ad Scams

While your monetization team may have workflows in place for addressing scam ads, a manual approach cannot guarantee the elimination of fraud ads in your app. Scammers weaponize the shortcomings of ad networks and their ability to detect scams, meaning you have to stay ahead. A real-time, automated solution like AppHarbr monitors attempts to serve fraud and blocks creatives pushed through by scammers. By implementing AppHarbr, your need for manual QA drops, preventing support emails with networks trying to track down bad ads.

Effective defense against financial scam ads demands clear, consistent adoption of proven best practices tailored explicitly to mobile app developers and publishers. In addition to AppHarbr’s ability to prevent fake ads from being served, it can also alert you and the network that passed it of the issue. The automation of this process cuts out the need for developers to manually attempt to figure out where the scam came from, as well as the back and forth with relevant parties in an attempt to solve the issue. This is both more time-efficient and more effective than existing manual processes.

Ultimately, developer vigilance, strategically combined with integrated automated detection tools, enables publishers can continually protect their user experience, revenue stability, and brand equity against financial ad scams. By embedding these best practices deeply into operational culture, publishers transform ad quality management from reactive firefighting to proactive resilience, safeguarding long-term growth and trust across their mobile app portfolios.

Securing Long-Term Growth by Eliminating Financial Scam Ads

Financial scam ads are not just trouble for users—they are a critical business threat for developers and publishers, undermining app reputation, monetization, user retention, and regulatory compliance. Successfully addressing and mitigating this growing challenge demands an end-to-end approach, combining rigorous compliance with automated detection solutions, clear reporting mechanisms, and developer-led best practices. Proactively embedding these strategies into daily operations positions publishers’ apps for sustainable growth and trust.

Ready to proactively shield your mobile apps from financial scam ads? Contact AppHarbr today for a personalized ad-quality assessment and discover how leading publishers keep their monetization secure and compliant.